Cannabis Taxes

At a special election held on November 4, 2014, the voters of the City of Desert Hot Springs passed and adopted the following taxes in connection with the City's Medical Marijuana Program:

Cannabis Cultivation Tax (Measure HH)

Any person or entity cultivating marijuana for casual/recreational use in the City shall pay an annual tax of $10 per square foot for space utilized in connection with the cultivation of marijuana for casual/recreational use.

In 2024, the City Council amended the cultivation tax to a monthly tax rate of $5.75 per square foot.

Cannabis Sales Tax - Dispensaries (Measure II)

A monthly 10% tax on the proceeds from the sale/provisions of cannabis.

In 2025, the City Council amended the retail tax to 5% of all sales.

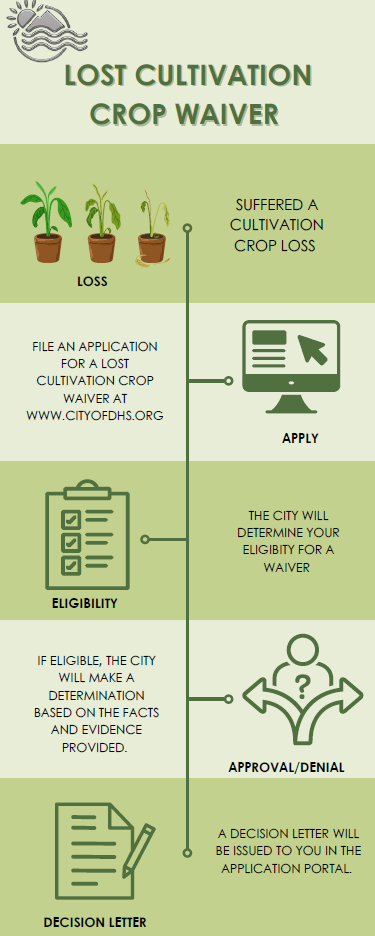

Lost Cultivation Crop Waiver

In its sole discretion, the City may grant a lost cultivation crop tax waiver to a cannabis cultivation facility that has lost its cannabis crops if the City determines that the facility meets ALL the eligibility requirements. If an eligible cannabis cultivation facility's lost cultivation crop tax waiver application is approved pursuant to Title 3 "Revenue and Finance" Chapter 3.37 "Lost Cultivation Crop Waiver," the City Manager or designee shall have the sole discretion to determine the amount of the tax waiver within budgetary limitations, but no greater than $75,000.

A cannabis cultivation facility must meet ALL of the following eligibility requirements for a lost cultivation crop waiver:

- The cannabis cultivation facility entity has not been granted a lost cultivation crop tax waiver in the prior 12 months.

- The cannabis cultivation facility is in good standing with the City, with no active Code compliance matters or tax delinquencies.

- The cannabis cultivation facility has not intentionally caused or significantly contributed to the cause of the failed crop.

- The failed crop is not the result of a natural disaster or an Act of God.

- Preventative measures were not readily and reasonably knowable to the cannabis cultivation facility prior to the events leading to the failed crop.

A lost cultivation crop tax waiver application shall be rejected if the cannabis cultivation facility fails to meet all of the eligibility requirements.

To Apply For a Lost Cultivation Crop Waiver:

A cannabis cultivation facility desiring or proposing to apply for a lost cultivation tax waiver shall file with the City Manager or designee a written application as so required by the provisions of this chapter. Each such application shall contain clearly and truthfully, under oath or affirmation, set forth and show, in addition to such other information as the City Manager shall require.

Apply for a lost cultivation crop waiver HERE.

For more information on the Lost Cultivation Crop Waiver click HERE.